B2B BNPL Unleashed: The Advantages for Tech Enterprises

Once upon a time in the realm of Fintech, there existed emerging markets teeming with untapped potential. In this land of opportunities, where startups sprouted like wildflowers and innovation was the currency of growth, a financial revolution was quietly unfolding. This revolution was none other than the Buy Now, Pay Later (BNPL) phenomenon, and it was changing the rules of the game for businesses of all sizes.

A Glimpse into the Past

Our story begins with the humble origins of BNPL. It arrived as a breath of fresh air, offering consumers the magical ability to acquire products and services today and pay for them later. At first, this novel concept faced skepticism and raised eyebrows. Critics wondered about the consequences of this newfound financial freedom.

But as the years rolled by, something extraordinary happened. BNPL matured and evolved, proving its worth to both consumers and businesses. No longer just a tool for individual shoppers, BNPL stepped onto the grand stage of B2B transactions.

The Spark of Transformation: B2B BNPL Emerges

In our tale of Fintech and innovation, B2B BNPL emerged as a hero. It wasn't just about swiping cards or clicking buttons anymore; it was about empowering businesses to make essential purchases and investments without the burden of upfront costs. Imagine a budding SaaS company in an emerging market, trying to develop cutting-edge software that could change the world. They needed resources, and they needed them fast.

Traditional financing methods came knocking, but they brought with them equity dilution and financial entanglements. It was a daunting prospect for our brave startup. But then, in walked B2B BNPL, dressed in digital armor, bearing the gift of non dilutive capital. It was the lifeline they had been waiting for.

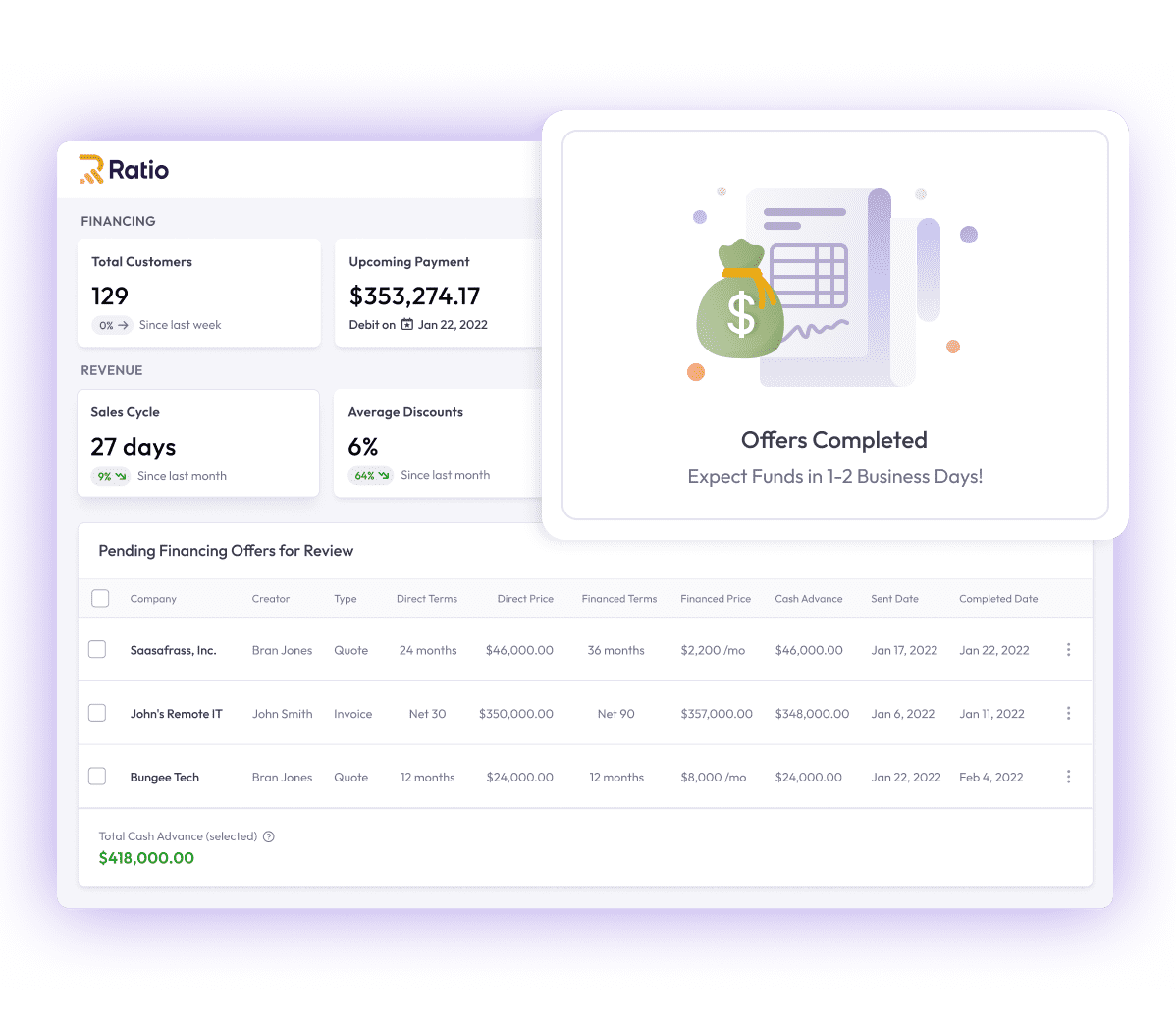

The Radiance of Ratio Tech

Amidst this transformative landscape, a star was born: Ratio Tech. Ratio Tech was no ordinary Fintech company; it was a beacon of hope for startups in emerging markets. Armed with a deep understanding of the challenges faced by businesses in these dynamic landscapes, Ratio Tech set out on a quest to empower them.

Ratio Boost and Ratio Trade: The Dynamic Duo

Ratio Tech introduced two powerful tools into our story: Ratio Boost and Ratio Trade. Imagine Ratio Boost as a trusty sidekick, always ready to provide startups with the capital they needed to scale, innovate, and thrive. No equity dilution, no strings attached—just a helping hand to propel them forward.

Then there was Ratio Trade, the magical portal that allowed businesses to transform their recurring revenue contracts into upfront capital. It was like turning future dreams into present realities, all with the wave of a digital wand. Ratio Trade's flexibility and ingenuity made it an indispensable asset on this adventurous journey.

The Case of Webscale and Ratio Tech

Our tale wouldn't be complete without a real-life hero. Enter Webscale, a SaaS company navigating the challenging terrain of emerging markets. Webscale's journey was filled with aspirations, but like any hero, they faced their share of trials. What they needed was a partner who understood their quest for growth and was willing to share in their risks and rewards.

The Ratio Tech Difference: Where Innovation Meets Empowerment

What set Ratio Tech apart from the rest was their commitment to the journey. They recognized that emerging markets weren't just about numbers; they were about people, dreams, and the relentless pursuit of innovation. Ratio Tech understood that one size didn't fit all in this grand adventure.

Their solutions were tailor-made to suit the unique needs of each business. In the ever-changing landscape of emerging markets, Ratio Tech was the compass that guided startups to success. They ensured that founders retained control of their destiny, their visions intact, and their dreams unburdened by traditional financial shackles.

Conclusion: The Journey Continues with Ratio Tech

And so, our story continues, with Ratio Tech leading the charge in empowering startups and businesses across emerging markets. With each passing day, they unlock new chapters of growth and prosperity, proving that in the world of B2B BNPL, they are the true trailblazers.

In this dynamic realm of innovation and finance, Ratio Tech's journey is far from over. It's a journey filled with excitement, challenges, and triumphs, where they stand as the unwavering ally of startups and entrepreneurs. Ratio Tech isn't just a Fintech company; it's the guardian of dreams, the enabler of growth, and the keeper of the flame that lights the way in the grand adventure of emerging markets.

As you venture forth in this world of endless possibilities, remember that Ratio Tech is the key to your non dilutive capital needs. With them by your side, your journey in emerging markets becomes not just exciting but also legendary. In the story of B2B BNPL and innovation, Ratio Tech is the chapter that changes everything.

Once upon a time in the realm of Fintech, there existed emerging markets teeming with untapped potential. In this land of opportunities, where startups sprouted like wildflowers and innovation was the currency of growth, a financial revolution was quietly unfolding. This revolution was none other than the Buy Now, Pay Later (BNPL) phenomenon, and it…

Recent Posts

- Your Trusted Choice for Premier Plumbing Services in Lexington, KY

- The Premier Ohio Cavapoo Breeder Elevating Puppy Adoption

- Ironchess SEO + Marketing Unveils Social Media Pest Control Strategies

- Forest Moving and More LLC: Your Premier Portland Moving Company for Local and Long-Distance Relocations

- Elevating Roofing Standards in Zanesville, Ohio